Stimulus Check 2 Married Filing Separately

If you ve already filed your 2019 return the status you used will determine if you and your spouse receive one payment for those who file jointly or two married filing separately.

Stimulus check 2 married filing separately. The amount of the stimulus check is gradually reduced once agi exceeds these limits. Whether you re married or unmarried it shouldn t affect the maximum amount you re eligible to receive. If you are a married couple filing jointly and have an adjusted gross income greater than 150 000 you can determine your exact payment amount by performing the following calculation.

Stimulus payment amounts will be phased out for people at certain income levels. Someone filing as head of household with an agi above 124 500 would not receive a stimulus check. Now the bad news.

Your check will be gradually reduced to zero if you re single married filing a separate tax. Single or married filing separately. A couple filing jointly would not receive a stimulus check once agi tops 174 000.

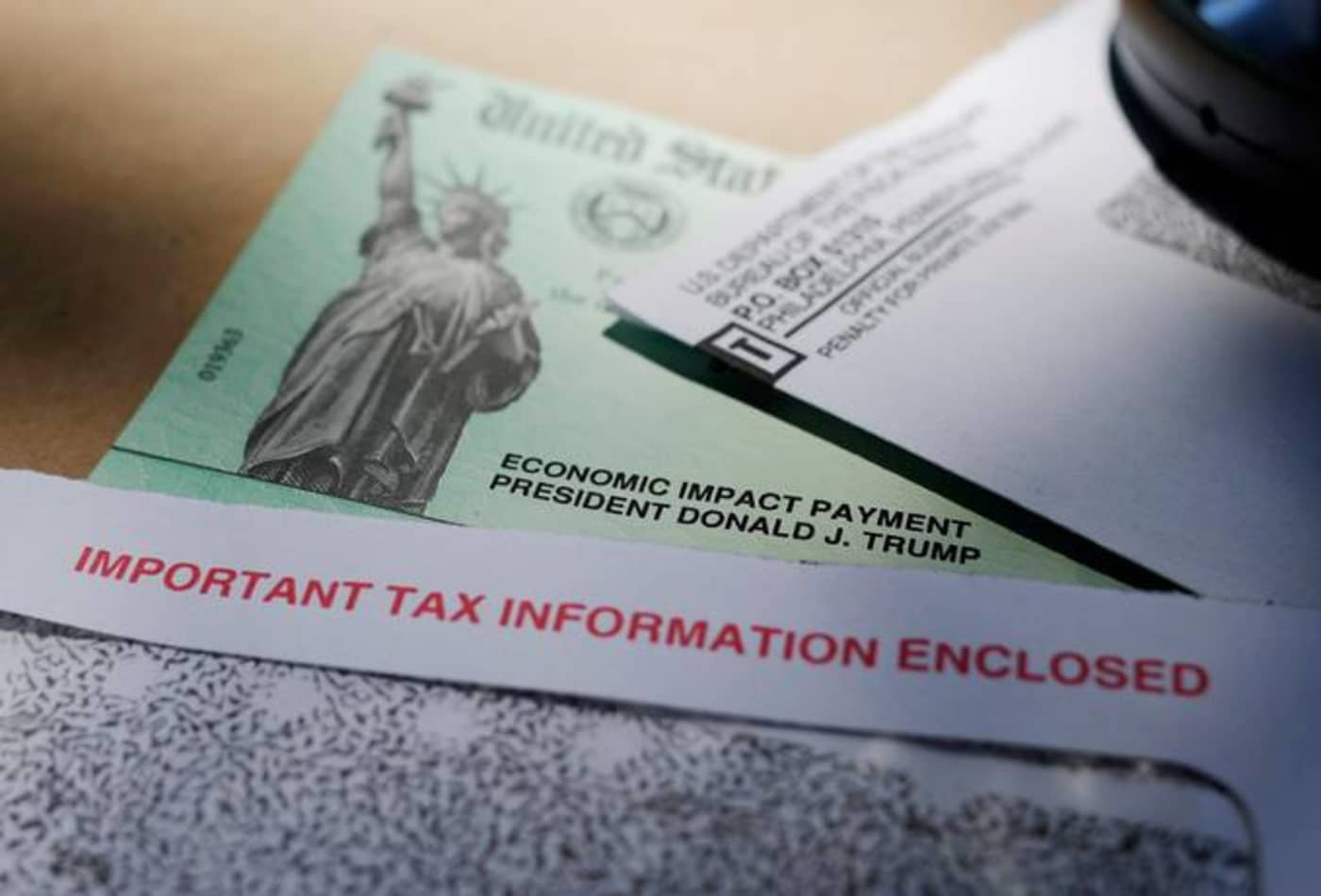

Head of household. All single people and married individuals filing separately from their spouses with adjusted gross incomes below 75 000 received the full 1 200 and an additional 500 for each child under the. The cares act stimulus payments officially defined as tax rebates have been sent to individuals with an annual income of 75 000 or less and to married couples filing jointly who made less than 150 000 combined.

How does the stimulus check calculator estimate reduced payments. Married couples filing jointly can receive 2 400 while two single people or a married.

/posttv-thumbnails-prod.s3.amazonaws.com/04-15-2020/t_09e01f07ed8649adb61b6dbf5a83c7b6_name_d794138a_7eb3_11ea_84c2_0792d8591911_scaled.jpg)