Stimulus Bill Update Ppp Tax

The bill extends the refundable payroll tax credits for paid sick and family leave enacted in the families first coronavirus response act p l.

Stimulus bill update ppp tax. Congress is behaving today allowing ppp borrowers to subtract ppp expenses and not need to contain loan forgiveness in earnings. New coronavirus stimulus bill passes congress with ppp loan updates and tax implications. But little has been written about whether the new law will allow ppp borrowers to deduct the expenses that they paid to receive forgiveness and many ppp borrowers will not survive if they have a big tax bill for 2020 that is technically due by estimated payment on or before december 31st 2020.

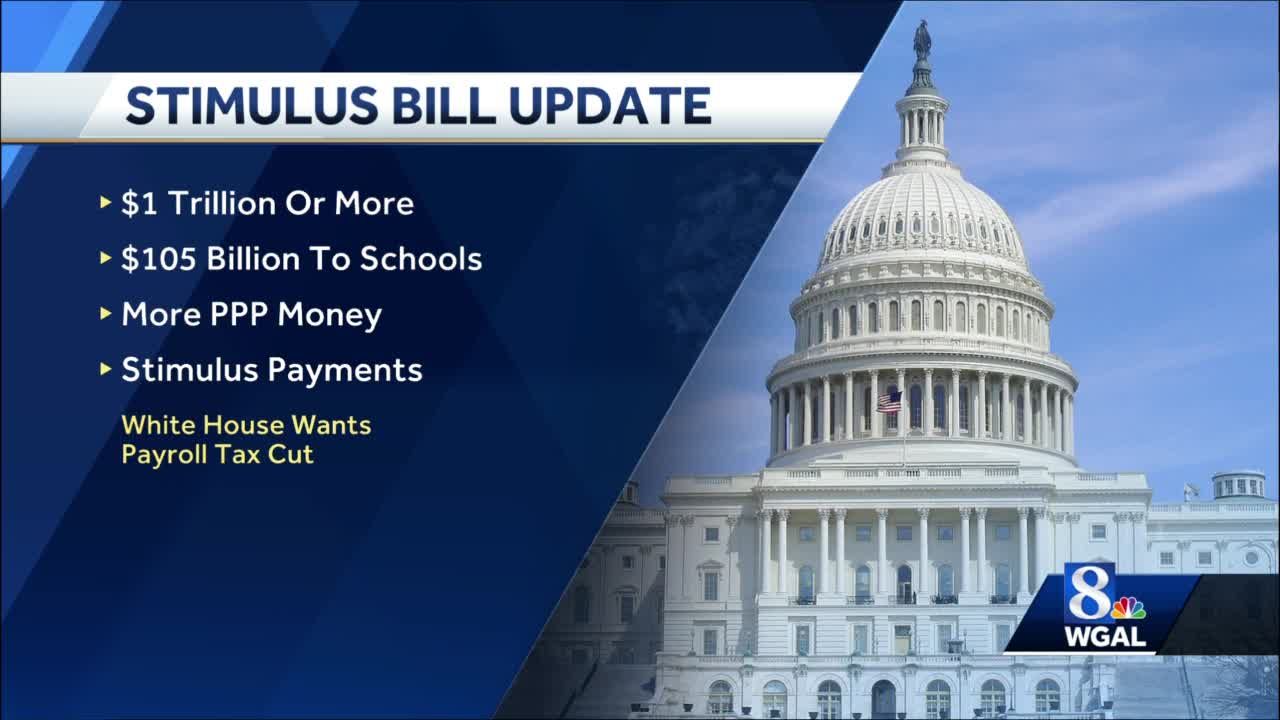

There is welcome relief for small businesses. The 900 billion covid 19 stimulus bill of december 2020 improves the paycheck protection program ppp2. Includes set asides to support first and second time ppp borrowers with 10 or fewer employees first time ppp borrowers that have recently been made eligible and for loans made by community lenders.

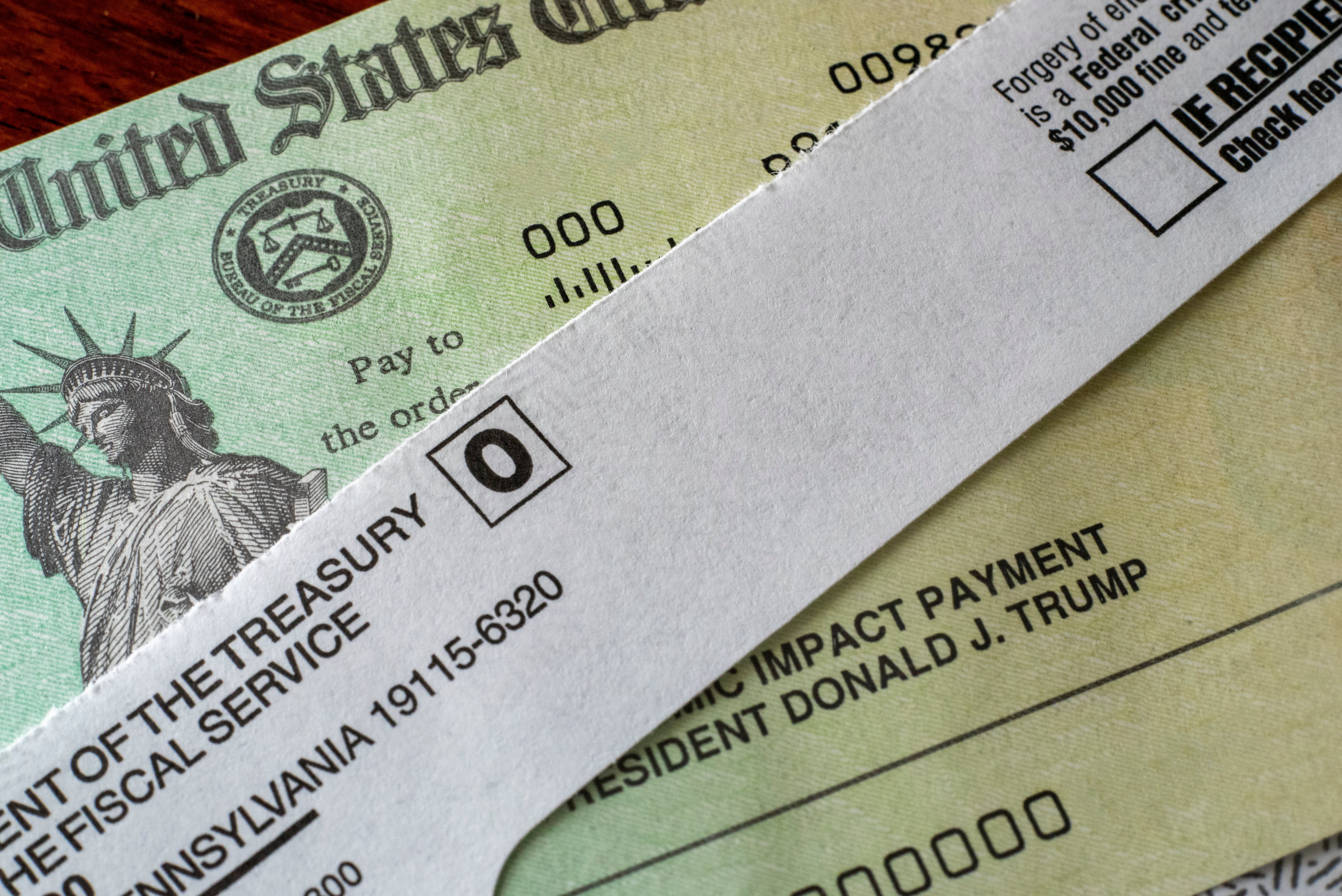

Along with also the shareholders of s corporations will appreciate. Ppp borrower tax relief under stimulus bill it s finally happening. Congress also implemented other aid including checks of up to 0 to every taxpayer.

If you are a small business owner the covid 19 stimulus package that congress passed on monday evening december 21 2020 has some very good news. New stimulus bill brings ppp aid tax relief to small business small business trends. Ppp loans are forgivable and despite normal tax rules if the loan is forgiven that will not be income.

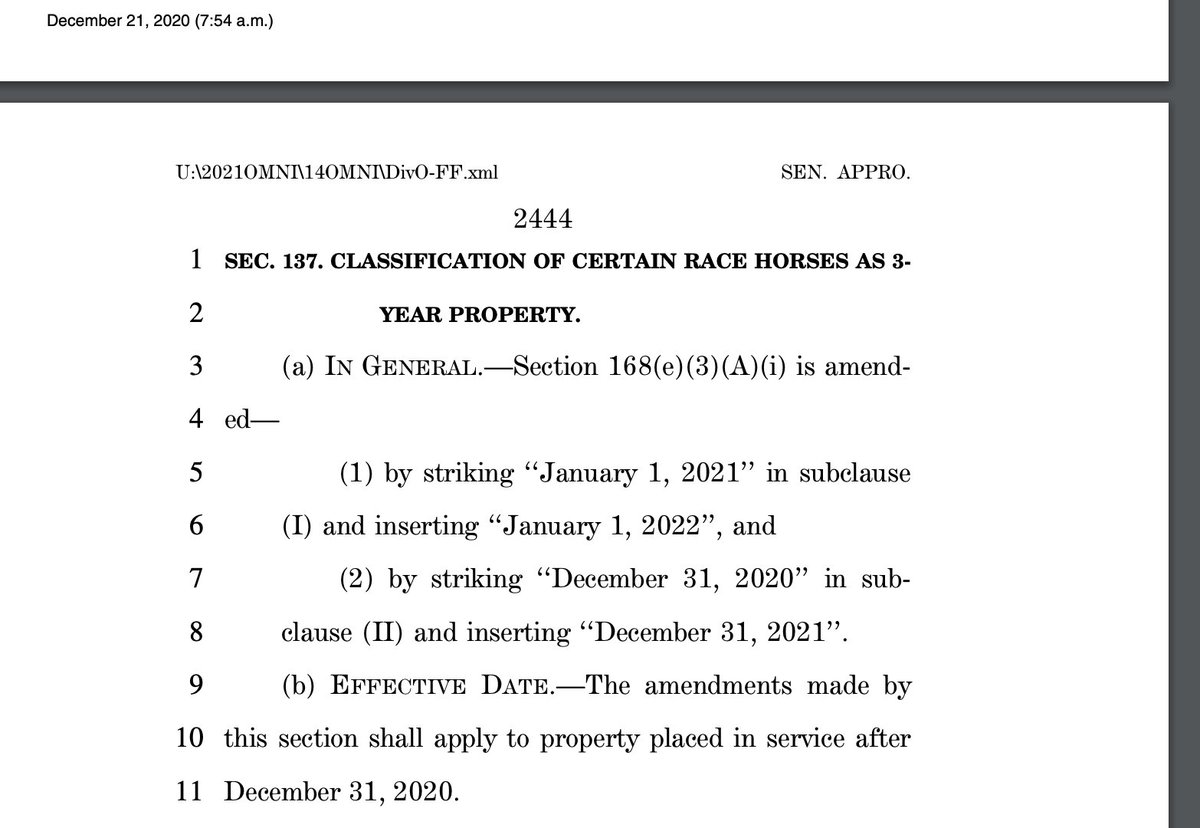

In addition to more paycheck protection program funds available congress passed tax relief for small businesses. December 20 2020 11 19 pm 1 6k views. Tax deductibility for ppp expenses.

It also modifies the payroll tax credits so that they apply as if the corresponding employer mandates were extended through march 31 2021. If you are a small business owner the covid 19 stimulus package that congress passed on monday evening december 21 2020 has some very good news. The bill also specifies that business expenses paid with forgiven ppp loans are tax deductible.