Irs Stimulus Money Calculator

If you earn more than 87 000 in adjusted gross income as an individual or 174 000 as a couple then you probably will not.

Irs stimulus money calculator. If you don t usually file taxes how to estimate your stimulus money. Adjusted gross income as the name implies is your gross income wages dividends capital gains retirement distributions and other income minus certain adjustments such as educator expenses student loan interest alimony. The stimulus check money that you receive from the federal government is not taxable meaning it will not be included in your yearly taxable income in 2020.

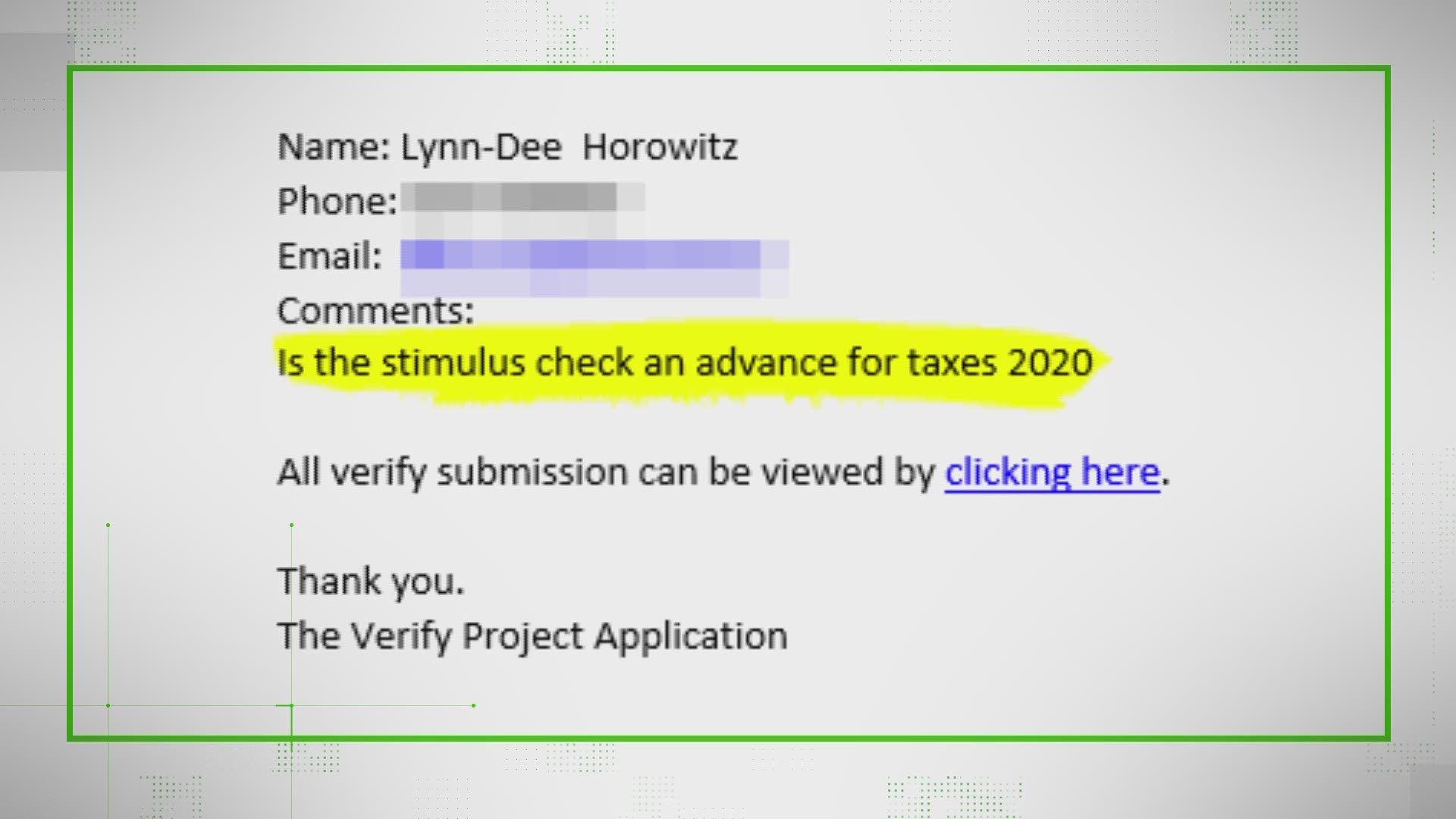

The irs also does not view your stimulus check as an advance on your tax refund for 2020 as they are entirely distinct from one another. Even if you haven t filed a tax return you can estimate your agi and enter the amount into the calculator to get a ballpark estimate of your possible stimulus payment. Millions of americans have received their 600 stimulus checks but hopes remain high for a.

With the first checks the irs automatically sent stimulus checks to many who normally aren t required to file a tax return. Your 2019 tax return will be used to determine whether you re eligible for a stimulus payment. Use our calculator to estimate your payment if congress passes the cash act for 2 000 stimulus checks.