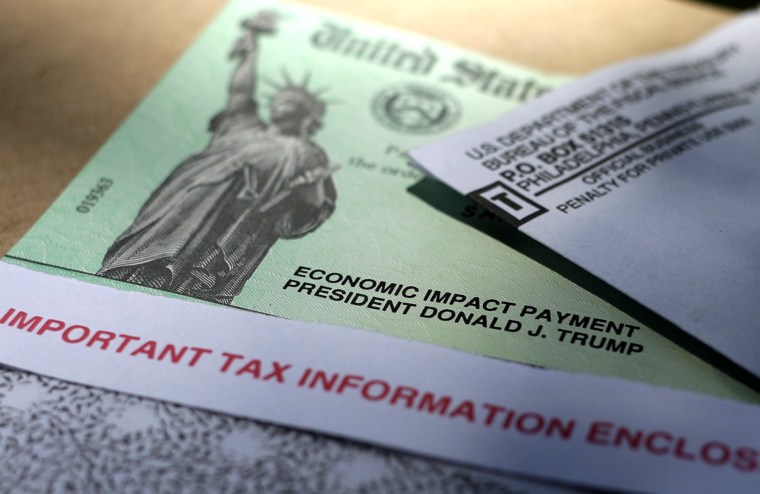

Can You Appeal Stimulus Check Amount

A number of stimulus checks still have to go out.

Can you appeal stimulus check amount. Wasn t eligible for a stimulus check based on 2018 tax filing but was eligible based on 2019 tax filing. The amount of the stimulus check is gradually reduced once agi exceeds these limits. This means your.

Many who heard biden calling for 2 000 stimulus checks including some lawmakers hoped that biden would up the amount to 2 000 payments in addition to the 600. First double check that you qualify for a stimulus check. A couple filing jointly would not receive a stimulus check once agi tops 174 000.

Married couples will receive 500 for each child in the household. Your stimulus check is reduced by 5 of the amount over the phase out floor. That said there are some steps you can take to be proactive.

If you believe the amount of your stimulus check is incorrect here s what to know about fixing it. But since this is an urgent situation the government is using the information it already has to determine the amount you get now. If you filed a tax return in 2018 or 2019 the irs will use the most recent information to determine your eligibility for a payment based on income thresholds for receiving a stimulus check.

Adjusted checks will go out to couples making up to 198 000. Hey guys i m in a very edge case situation and after scouring google i can t really seem to find a correct answer. Single parents can make up to 112 500 a year and still receive the.

The check is technically an advance payment of a refundable credit on your 2020 tax return which you won t have to file until april 15 2021. The irs explained that if your stimulus check is for less than what you think you should ve received you ll be able to claim the additional amount when you file your 2020 tax return next year. You received too little if you had a child this year and your stimulus check did not include the.