Bipartisan Stimulus Bill Ppp

Unpacking ppp updates from the latest stimulus bill jan 4 2021.

Bipartisan stimulus bill ppp. The top 10 ppp changes in the bipartisan emergency covid relief act of 2020. Another stimulus bill is on the horizon. Ppp provisions in the bipartisan emergency covid relief act of 2020.

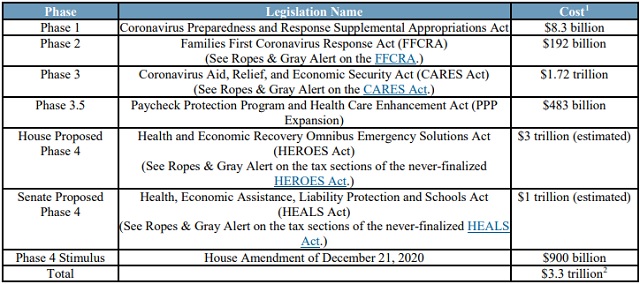

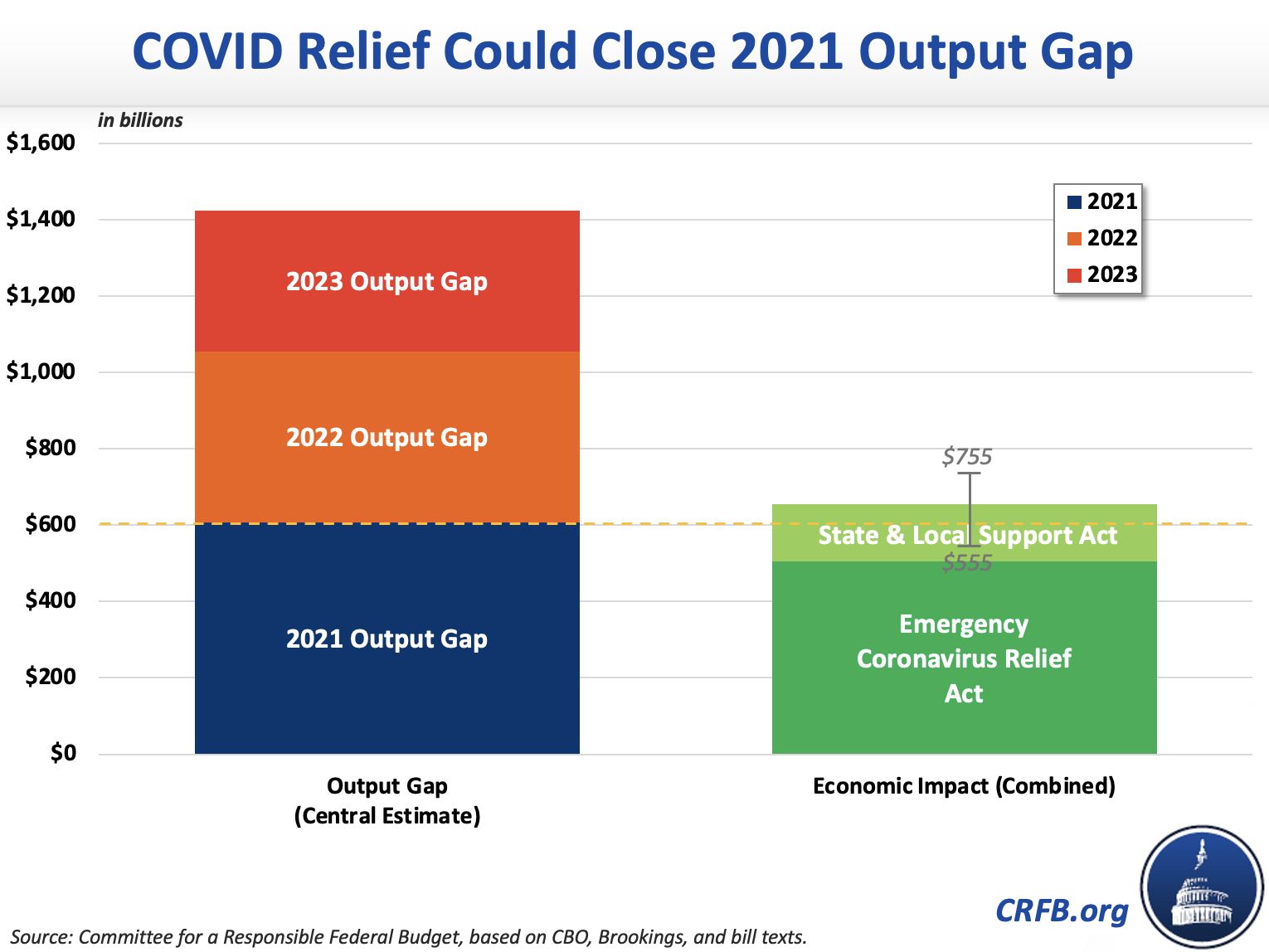

Angus king revealing the bipartisan covid 19 stimulus package the proposal includes 288billion in small business aid such as ppp loans 160billion in state and local government relief and 180billion to fund a 300 per week supplemental unemployment benefit through march. Ppp provisions in the bipartisan emergency covid relief act of 2020 covid 19 resource following months of on again off again negotiations among representatives of both parties both chambers of congress the u s. 116 136 on march 27 2020 appears in limbo as numerous uncertainties remain concerning loan forgiveness deductibility of ordinary business expenses and whether small businesses will have access to another round of loans.

Into law based on the framework summary of the bipartisan emergency covid. We have previously mentioned that congress would likely do this but as of yet this bill has not passed. This changes is likely to reduce tax revenues significantly relative to current law but much of the cost was inadvertently scored in the original bills.

Generally additional ppp legislation has bipartisan support in both the house and senate. O eligibility would be limited to small businesses with 300 or fewer employees that have. Bipartisan emergency covid relief act of 2020 framework summary december 9 2020.

The bipartisan covid stimulus bill being discussed and possible passed this week contains a provision to make expenses related to ppp loan forgiveness fully deductible. Justin is a partner at aprio and a nationally recognized ppp expert. Although the proposal rescinds funds from the ppp program and the federal reserve s lending facilities those funds would not have been spent anyway under current law so the actual.

Bill text totals do not sum due to rounding. He has conducted over 100 ppp loan forgiveness educational webinars reaching over. The bill includes more than 284 billion for first and second forgivable paycheck protection program loans expanded ppp eligibility for nonprofit organizations and news outlets and modifications.